- Sales Invoice myDATA type: 1.1

- Sales Invoice / Intra Community Supplies myDATA type: 1.2

- Sales Invoice / Third Country Supplies myDATA type: 1.3

- Invoice of Rendered Services myDATA type: 2.1

- Invoice of rendered services / Intra Community Supplies myDATA type: 2.2

- Invoice of rendered services / Third Country Supplies myDATA type: 2.3

Retail Sales Receipt

When selling goods to private individuals, you are required to issue a “Sales receipt” (myDATA document type 11.1). Typically, sales receipts must be specially marked for taxation purposes. Elorus integrates with SoftOne EINVOICING, a certified provider of electronic invoicing services, to issue legally stamped receipts.

Authorization variables

- Token: API key.

To find your API key open the Elorus web application and navigate to the "User Profile". The API key is personal and there's only one key per user.

- X-Elorus-Organization: Organization ID.

The organization whose data you wish to access. To find the Organization ID visit the Elorus web application and navigate to "Settings > Organization > Organization ID". Each organization has an ID of its own.

Client

1.1 Create a new contact

- The guide assumes you’re working on a new Elorus organization, so this step can be omitted.

First lets create a contact so there is someone to bill. Since the case is a “Retail Sales Receipt” no VAT number is needed and only minimal contact information will be used. In a business context, contacts are individuals or businesses whom you transact with; typically your clients, leads, suppliers and partners. Since Elorus will let you manage your sales as well as your expenses, a contact may represent either a client or a supplier (or even both).

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/ -d '{"client_type": "4", "first_name": "Πελάτης", "last_name":"Λιανικής", "is_client": true, "is_supplier":false}'

1.2 Get contact ID

Search e.g. by “first_name” & “last_name”, to get the contact ID. Retrieved contact ID in this case is “2476845216061982422”.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/?search="Πελάτης Λιανικής"&search_fields=first_name,last_name

Document type

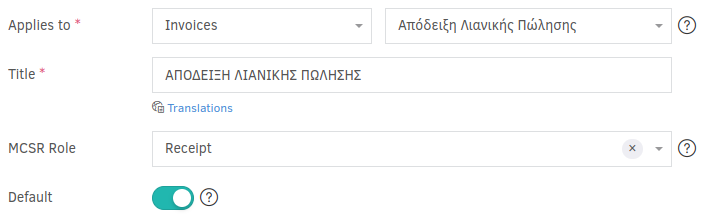

2.1 Create a “Retail Sales Receipt” document type

In this case, a “Retail Sales Receipt” document type will be needed. There is no “Retail Sales Receipt” document type pre-created and API does not support document type creation. So in order to create it, use of Elorus’ UI is mandatory.

- Login to your Elorus account

- Go to: “Settings -> Document Types”

- Click “+Add” on top right corner

- And set it up as the picture below. Title used is for example purposes, the field can take any name.

- Click “Save”

2.2 Get document type ID

Search by “title”, to get the document type ID. Retrieved document type ID in this case is “2476894925484984004”.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/documenttypes/?search="ΑΠΟΔΕΙΞΗ ΛΙΑΝΙΚΗΣ ΠΩΛΗΣΗΣ"&search_fields=title

Taxes

3.1 About taxes

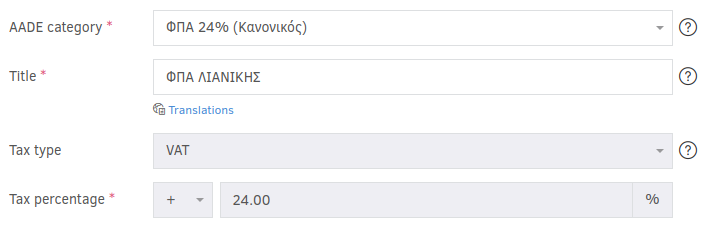

By default there are some taxes preset in Elorus. Usually 24% tax is used for Greece “Retail Sales Receipt” so the preset tax will be retrieved and used. In case there is a need for a new tax to be created, use of Elorus’ UI is mandatory.

Optional steps to create new tax:

- Login to your Elorus account

- Go to: “Settings -> Taxes”

- Click “+Add” on top right corner

- And set it up as the picture below. AADE category and title used are for example purposes.

- Click “Save”

3.2 Get taxes ID

Search by “percentage”, to get the tax ID. Retrieved tax ID in this case is “2476911428611605999”. Make sure that “aade_type”:1 is in the response packet.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/taxes/?search="24"&search_fields=percentage

Receipt creation

4.1 Create Retail Sales Receipt

The final step, is to create the Receipt itself. The list below describes all the needed fields.

- X-Elorus-Organization: your organization ID

- calculator_mode: sets your values as “initial” or “total”, meaning before or after taxes.

- When “total” is used, then it is mandatory to use “unit_total” in items.

- When “initial” is used, then it is mandatory to use “unit_value” in items.

- Depending on the situation, Elorus will calculate the taxes accordingly.

- client: Client id - In this case we created a “ΠΕΛΑΤΗΣ ΛΙΑΝΙΚΗΣ” contact.

- draft: true or false depending on the need to issue immediately an invoice or not. If true, the invoice will not reach MyData/Softone, until issued.

- documenttype: Document Type ID - In this case we created a “ΑΠΟΔΕΙΞΗ ΛΙΑΝΙΚΗΣ ΠΩΛΗΣΗΣ” document type, associated with the corresponding “aade type”.

- My data specific fields: mydata_document_type - mydata_classification_category - mydata_classification_type - paid_on_receipt - payment_method

- mydata_document_type: aade type

- mydata_classification_category: income type aade

- mydata_classification_type: classifications of Ε3 aade

- paid_on_receipt: Invoice amount that was paid when invoice was issued. If “0” then you don’t need to send payment_method since Elorus will automatically apply payment_method as on credit.

- payment_method:

- “1”: Domestic Payments Account

- “2”: Foreign Payments Account

- “3”: Cash

- “4”: Cheque

- “6”: Web Banking

- “7”: POS / e-POS

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/invoices/ -d '{"calculator_mode": "total", "currency_code": "EUR", "exchange_rate": "1.000000", "client": "2476845216061982422", "date": "2022-5-11", "draft": true, "documenttype": "2476894925484984004", "mydata_document_type": "11.1", "items": [{"title": "Γάντια Εργασίας", "unit_total": "12.4", "quantity": "1", "taxes": ["2476911428611605999"], "mydata_classification_category": "category1_2", "mydata_classification_type": "E3_561_003"}], "paid_on_receipt": "12.4", "payment_method": "3"}'