- Sales Invoice myDATA type: 1.1

- Sales Invoice / Intra Community Supplies myDATA type: 1.2

- Sales Invoice / Third Country Supplies myDATA type: 1.3

- Invoice of Rendered Services myDATA type: 2.1

- Invoice of rendered services / Intra Community Supplies myDATA type: 2.2

- Invoice of rendered services / Third Country Supplies myDATA type: 2.3

Retail Sales Credit Note

Credit notes are typically used to denote a client refund or a discount (credit) on future purchases. To cancel a sales receipt or a service receipt you must create a “Retail Sales Credit Note” (myDATA document type 11.4), whereas a “Credit invoice” must be created to refund an invoice.

Authorization variables

- Token: API key.

To find your API key open the Elorus web application and navigate to the "User Profile". The API key is personal and there's only one key per user.

- X-Elorus-Organization: Organization ID.

The organization whose data you wish to access. To find the Organization ID visit the Elorus web application and navigate to "Settings > Organization > Organization ID". Each organization has an ID of its own.

Client

1.1 Create a new contact

- The guide assumes you’re working on a new Elorus organization, so this step can be omitted.

First lets create a contact so there is someone to bill. In a business context, contacts are individuals or businesses whom you transact with; typically your clients, leads, suppliers and partners. Since Elorus will let you manage your sales as well as your expenses, a contact may represent either a client or a supplier (or even both).

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/ -d '{"client_type": "1", "company":"Elorus SA", "vat_number":"9876543210", "addresses":[{"address":"Theofilopoulou 13", "city":"Athens", "zip":"11743", "country": "GR", "ad_type": "bill"}], "is_client": true, "is_supplier":false}

1.2 Get contact ID

Filter e.g. by “company”, to get the contact ID. Retrieved contact ID in this case is “2482665622824027155”.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/?company="Elorus SA"

Document type

2.1 Get document type ID

In this case, a “Retail Sales Credit Note” document type will be needed. There is a “Retail Sales Credit Note” document type pre-created. Default title is “Απόδειξη επιστροφής”.

Search by “title”, to get the document type ID. Retrieved document type ID in this case is “2485602059089348112”. In case the title is changed or the document type is missing, use the Elorus UI to create a new one.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/documenttypes/?search="Απόδειξη επιστροφής"

Taxes

3.1 About taxes

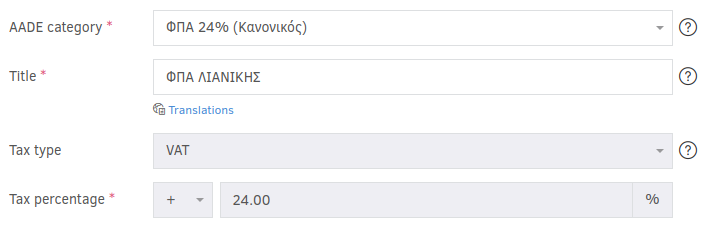

By default there are some taxes preset in Elorus. Usually 24% tax is used for Greece “Retail Sales Credit Note” so the preset tax will be retrieved and used. In case there is a need for a new tax to be created, use of Elorus’ UI is mandatory.

Optional steps to create new tax:

- Login to your Elorus account

- Go to: “Settings -> Taxes”

- Click “+Add” on top right corner

- And set it up as the picture below.

- Click “Save”

3.2 Get taxes ID

Search by “percentage”, to get the tax ID. Retrieved tax ID in this case is “2476911428611605999”. Make sure that “aade_type”:1 is in the response packet.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/taxes/?search="24"&search_fields=percentage

Credit note creation

4.1 Create a Retail Sales Credit Note

The final step, is to create the Credit Note itself. The list below describes all the needed fields.

- X-Elorus-Organization: your organization ID

- calculator_mode: sets your values as “initial” or “total”, meaning before or after taxes.

- When “total” is used, then it is mandatory to use “unit_total” in items.

- When “initial” is used, then it is mandatory to use “unit_value” in items.

- Depending on the situation, Elorus will calculate the taxes accordingly.

- client: Client id - In this case we created “Elorus SA” contact.

- draft: true or false depending on the need to issue immediately an invoice or not. If true, the Retail Sales Credit Note will not reach MyData/Softone, until issued.

- documenttype: Document Type ID - In this case we used “Απόδειξη επιστροφής” document type, associated with the corresponding “aade type”.

- My data specific fields: mydata_document_type - mydata_classification_category - mydata_classification_type - paid_on_receipt - payment_method

- mydata_document_type: aade type

- mydata_classification_category: income type aade

- mydata_classification_type: classifications of Ε3 aade

- paid_on_receipt: Invoice amount that was paid when invoice was issued. If “0” then you don’t need to send payment_method since Elorus will automatically apply payment_method as on credit.

- payment_method:

- “1”: Domestic Payments Account

- “2”: Foreign Payments Account

- “3”: Cash

- “4”: Cheque

- “6”: Web Banking

- “7”: POS / e-POS

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/creditnotes/ -d '{"calculator_mode": "total", "currency_code": "EUR", "exchange_rate": "1.000000", "client": "2482665622824027155", "date": "2022-5-23", "draft": true, "documenttype": "2485602059089348112", "mydata_document_type": "11.4", "items": [{"title": "Γάντια Εργασίας", "unit_total": "12.4", "quantity": "1", "taxes": ["2476911428611605999"], "mydata_classification_category": "category1_3", "mydata_classification_type": "E3_561_003"}], "paid_on_receipt": "12.4", "payment_method": "3"}'