- Sales Invoice myDATA type: 1.1

- Sales Invoice / Intra Community Supplies myDATA type: 1.2

- Sales Invoice / Third Country Supplies myDATA type: 1.3

- Invoice of Rendered Services myDATA type: 2.1

- Invoice of rendered services / Intra Community Supplies myDATA type: 2.2

- Invoice of rendered services / Third Country Supplies myDATA type: 2.3

Accommodation Tax

The “Accommodation Tax”, is a tax that charges the resident (client) who has used a room or an apartment and is imposed after his stay in the accommodation, and before his departure from it. The amount of the charged tax, depends on the category of the accommodation.

This guide demonstrates how to create “Accommodation Tax” for clients located in Greece (myDATA document type “8.2 Accommodation Tax”)

- In case the SoftOne EINVOICING integration is activated in your organization, special attention is needed as it's not possible to cancel the submission, and creating a credit note is not an option either.

- If the "Accommodation Tax" is linked to a "Sales Invoice", the invoice must have been submitted to myDATA prior to submitting the "Accommodation Tax".

Authorization variables

- Token: API key.

To find your API key open the Elorus web application and navigate to the "User Profile". The API key is personal and there's only one key per user.

- X-Elorus-Organization: Organization ID.

The organization whose data you wish to access. To find the Organization ID visit the Elorus web application and navigate to "Settings > Organization > Organization ID". Each organization has an ID of its own.

Client

1.1 Create a new contact

- The guide assumes you’re working on a new Elorus organization, so this step can be omitted.

First lets create a contact so there is someone to bill. In a business context, contacts are individuals or businesses whom you transact with; typically your clients, leads, suppliers and partners. Since Elorus will let you manage your sales as well as your expenses, a contact may represent either a client or a supplier (or even both).

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/ -d '{"client_type": "1", "company":"Elorus SA", "vat_number":"0123456789", "addresses":[{"address":"Theofilopoulou 13", "city":"Athens", "zip":"11743", "country": "GR", "ad_type": "bill"}], "is_client": true, "is_supplier":false}'

1.2 Get contact ID

Filter e.g. by “company”, to get the contact ID. Retrieved contact ID in this case is “2480647926494267071”.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/contacts/?company="Elorus SA"

Taxes

2.1 Create Rental Income

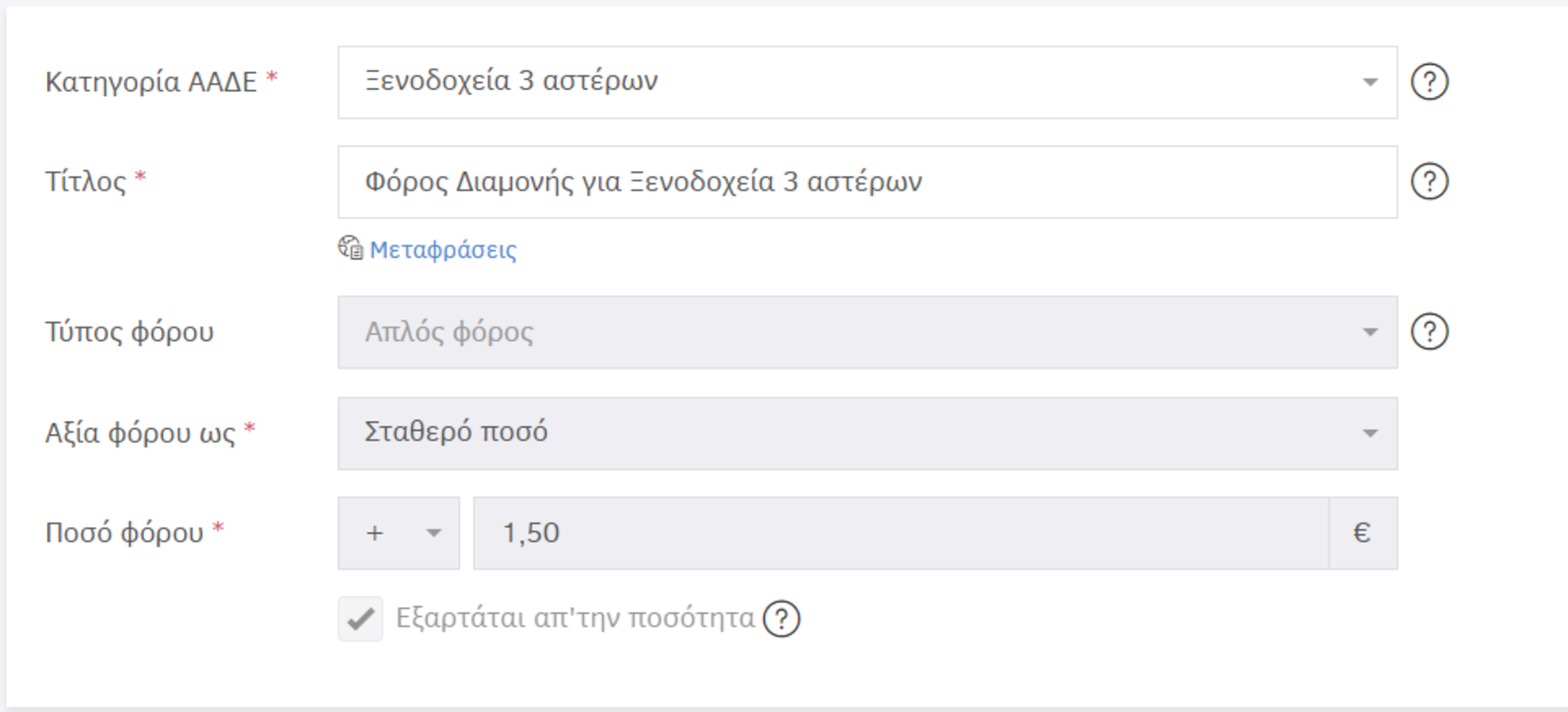

First, by going to the Elorus’ UI > menu Settings > Taxes > Add, you must enter the “Accommodation Tax” that applies to your business.

It is a one-time process to activate the ability to add “Accommodation Tax” to your account from now on.

2.2 Get taxes ID

Search by “title” e.g. “Ξενοδοχεία 3 αστέρων”, to get the tax ID. Retrieved tax ID in this case is “2624067035251869663”.

curl -X GET -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/taxes/?search="Ξενοδοχεία 3 αστέρων"&search_fields=title

Accommodation Tax creation

3.1 Create Accommodation Tax

The final step, is to create the “Accommodation Tax” as a received payment. The list below describes all the needed fields.

- X-Elorus-Organization: your organization ID

- date: Issue date

- transaction_type:“at”. Required field to denote the received payment as “Accommodation Tax”.

- taxes: The amount charged depends on the category of accommodation (e.g. a hotel with three stars is taxed differently to a hotel that has one star).

- quantity: Calculate the total tax rate as the product of the fixed amount (depends on the category of accommodation), multiplied by the quantity.

- contact: Contact id - In this case we created “Elorus SA” contact.

- at_invoice: Not required. Used when there is a need to relate an invoice with the received “Accommodation Tax” payment.

- myDATA specific fields:

- mydata_document_type: aade type 8.2 for “Accommodation Tax”

- payment_method:

- “1”: Domestic Payments Account

- “2”: Foreign Payments Account

- “3”: Cash

- “4”: Cheque

- “6”: Web Banking

- “7”: POS / e-POS

curl -X POST -H "Content-Type: application/json" -H "Authorization: Token ~Your-API-key~" -H "X-Elorus-Organization: ~Your-Organization-ID~" https://api.elorus.com/v1.1/cashreceipts/ -d '{"transaction_type":"at", "contact":"2480647926494267071", "date":"2022-11-30", "taxes":["2624067035251869663"], "quantity": "1", "mydata_document_type":"8.2", "payment_method": "3"}'